IN AE-4 2013-2026 free printable template

Show details

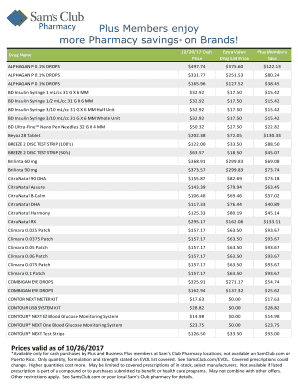

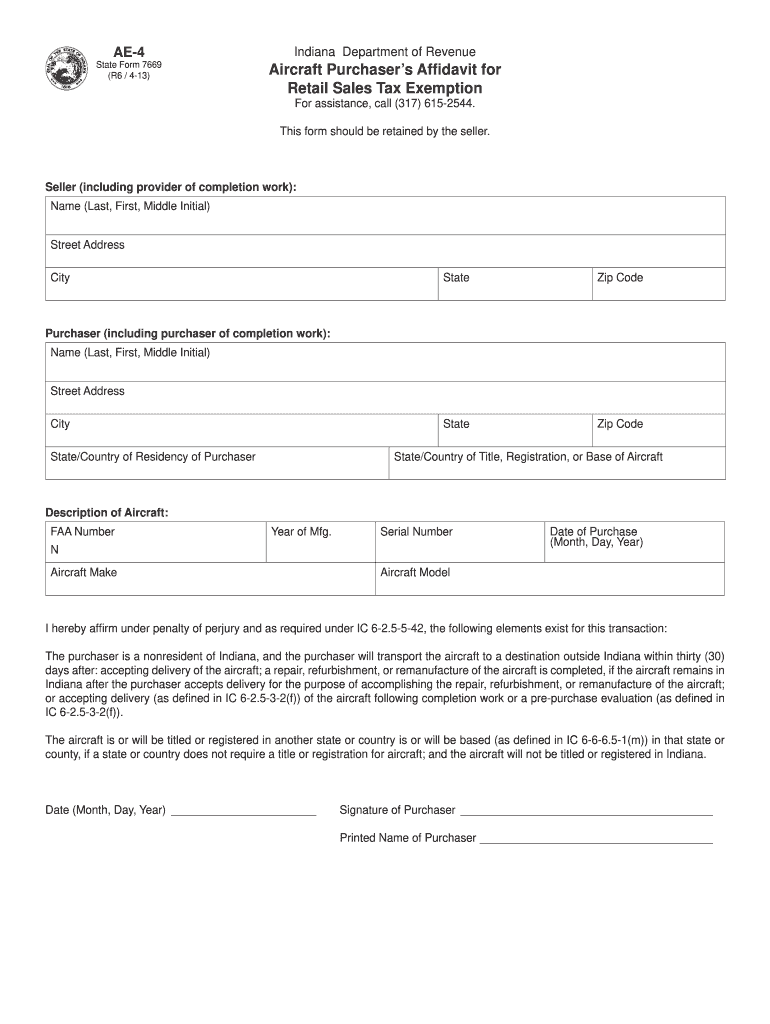

AE-4 Indiana Department of Revenue State Form 7669 R6 / 4-13 Aircraft Purchaser s Af davit for Retail Sales Tax Exemption For assistance call 317 615-2544. This form should be retained by the seller. Seller including provider of completion work Name Last First Middle Initial Street Address City State Zip Code Purchaser including purchaser of completion work State/Country of Residency of Purchaser Description of Aircraft FAA Number Year of Mfg. Serial Number N Aircraft Make Date of Purchase...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign indiana ae4 tax exemption form

Edit your indiana number identification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how much is indiana state tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ae 4 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit indiana income tax form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indiana state income tax form

How to fill out IN AE-4

01

Gather all necessary personal and financial information required for the form.

02

Start by filling out your personal details such as name, address, and contact information.

03

Provide your identification number or social security number as required.

04

Detail your income sources, including your employment and any other revenue streams.

05

Fill in your expenses, categorizing them as necessary (e.g., housing, utilities, transportation).

06

Review the form for completeness and accuracy.

07

Sign and date the form, ensuring that all required fields are filled out.

Who needs IN AE-4?

01

Individuals applying for a specific type of assistance or benefits that require documentation of income and expenses.

02

People who are undergoing a financial assessment related to a loan or support program.

03

Applicants seeking government aid or subsidies that necessitate disclosure of their financial situation.

Fill

indiana department of revenue address

: Try Risk Free

People Also Ask about what is the indiana department of revenue

How do I pay sales tax in Indiana?

You have a couple options for filing and paying your Indiana sales tax: File online at the Indiana Department of Revenue. You can remit your tax bill through their online system. AutoFile – Let TaxJar file your sales tax for you. We take care of the payments, too.

What is Indiana's tax pattern?

Income taxes Indiana imposes a flat 3.23% tax on the personal income. The base taxable amount is equal to the adjusted gross income determined on a payers federal tax return. The taxable amount can be lowered by applying several income tax deductions.

Is Indiana tax friendly?

Indiana Income Taxes Indiana has a flat rate of 3.15% of state adjusted gross income after modifications. Counties also levy income taxes. If state revenues reach certain thresholds, the state rate will drop to 3.1% for 2025 and 2026, to either 3% or 3.1% for 2027 and 2028, and to either 2.9%, 3% or 3.1% after 2028.

Is there a county tax in Indiana?

All Indiana counties have adopted a county income tax.

What is the most tax-friendly state?

MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. States that received a grade of A all share something in common: no state income tax. Washington and South Dakota — which both received a B — also have no state income tax.

Is Indiana a good tax state?

There also are jurisdictions that collect local income taxes. Indiana has a 4.90 percent corporate income tax rate. Indiana has a 7.00 percent state sales tax rate and does not levy any local sales taxes. Indiana's tax system ranks 9th overall on our 2023 State Business Tax Climate Index.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ae forms to be eSigned by others?

Once your ae form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit indiana estimated tax payments online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your income tax indiana to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit taxes in indiana on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign pay tax warrant indiana on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is IN AE-4?

IN AE-4 is a specific form used to report certain financial or informational data to tax authorities or regulatory bodies.

Who is required to file IN AE-4?

Organizations and individuals that meet specific criteria set by the tax authorities are required to file IN AE-4.

How to fill out IN AE-4?

To fill out IN AE-4, you need to follow the instructions provided with the form, ensuring all required fields are completed accurately.

What is the purpose of IN AE-4?

The purpose of IN AE-4 is to collect important financial information that supports tax compliance and regulatory oversight.

What information must be reported on IN AE-4?

The information required on IN AE-4 typically includes financial data, transaction details, and any other relevant information as specified by the tax authorities.

Fill out your IN AE-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana Tax Brackets is not the form you're looking for?Search for another form here.

Keywords relevant to indiana department of revenue number

Related to indiana state income tax rate

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.